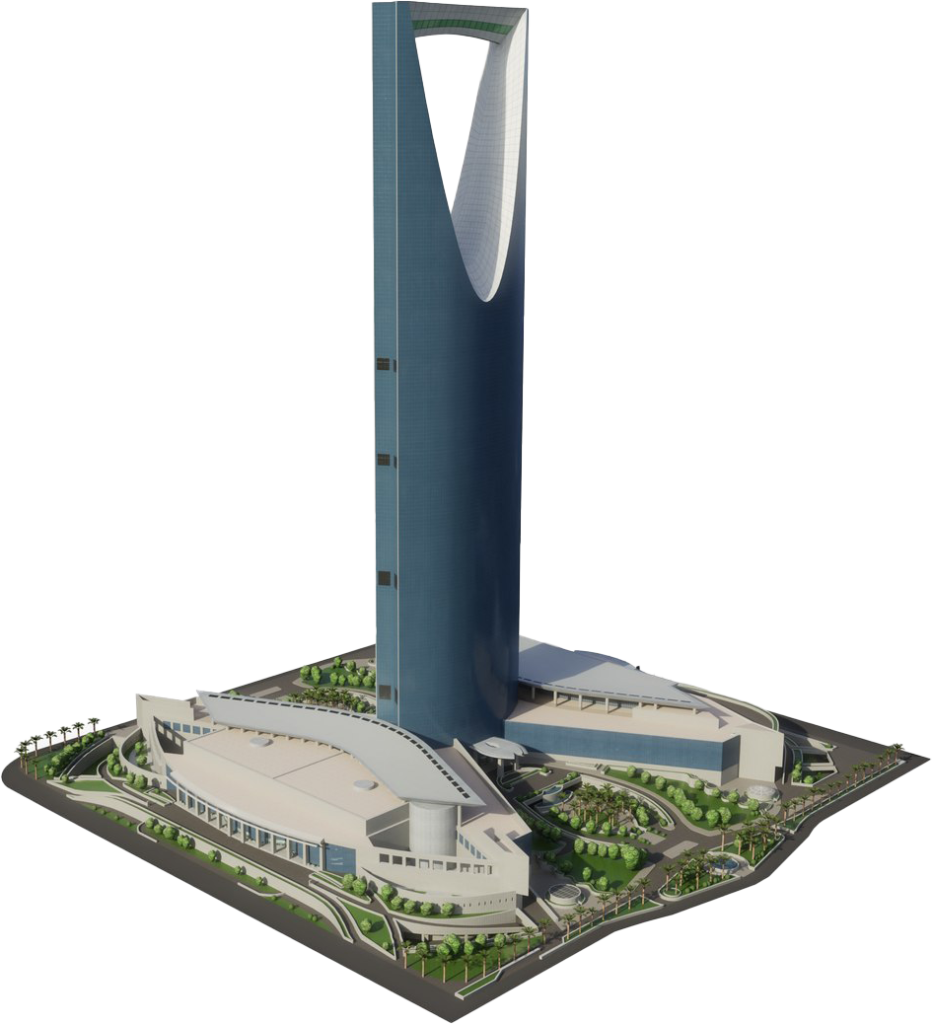

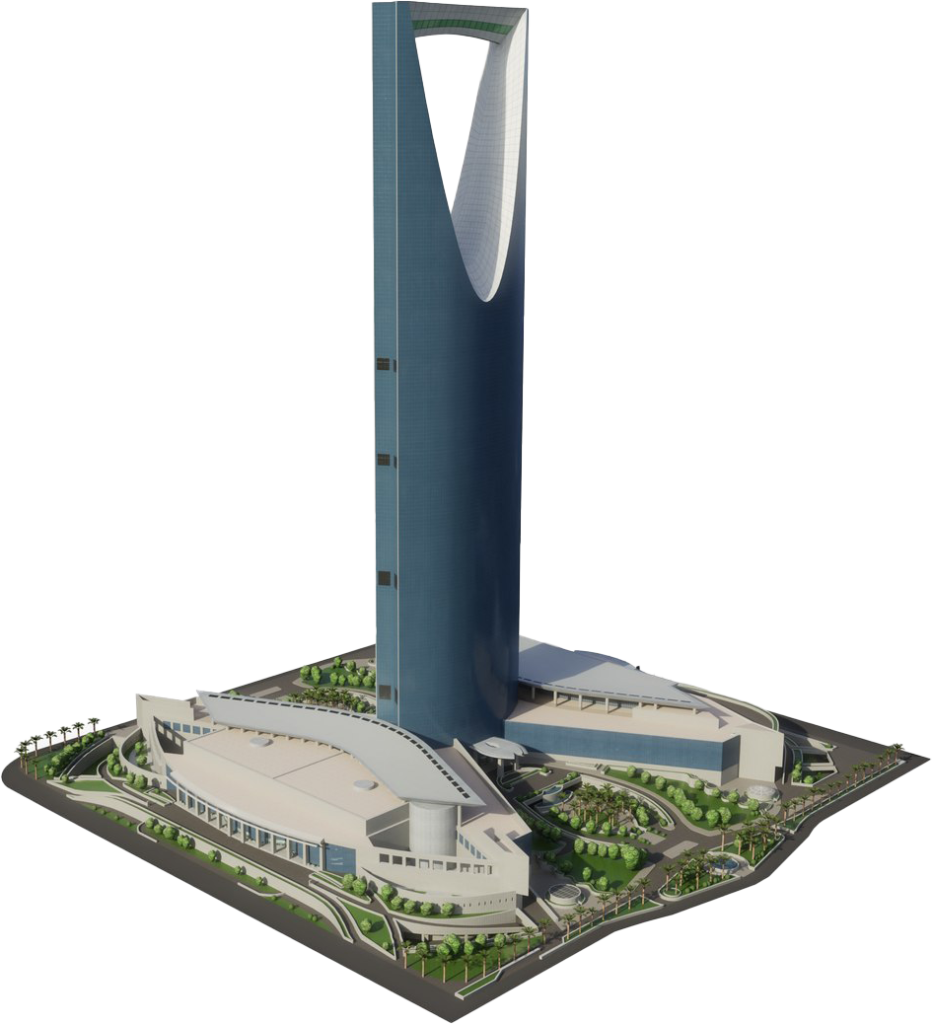

Expand Your Business to Saudi Arabia!

Elevate Your Business in Saudi Arabia with Decisive Zone

- 100% foreign business ownership

- Leverage KSA’s strategic global position

- No Physical Presence required

Embrace the Opportunities and Perks of Free Zone Business Setup in the UAE

Book your free consultation

- 100% FOREIGN BUSINESS OWNERSHIP

- Leverage KSA’s strategic global position

- No physical presence required

Book your free consultation

Expand Your Business to Saudi Arabia!

Elevate Your Business in Saudi Arabia with Decisive Zone

The Saudi Advantage

With Saudi Vision 2030 fueling monumental growth, the opportunity is ripe for Saudi expansion

Annual Investment

2.5% Of GDP

By 2040

Saudi GDP

$1 Tr+

In 2022

FDI Increase From 3.8% To

5.7%

By 2030

SME Contribution To GDP

35%

By 2030

Private Sector's Contribution

65%

By 2030

Explore Your Global Business Potential: Saudi Arabia

Explore the unique advantages of establishing your business in Saudi Arabia. Discover how the Saudi’s favorable tax environment and strategic location can boost your business growth.

-

Enjoy the Freedom of 100% Foreign Ownership Opportunities

Businesses can benefit from the freedom of 100% foreign ownership, providing control and flexibility in operations.

-

Leverage its Strategic Global Positioning

Strategically positioned, Saudi Arabia serves as a gateway connecting businesses to key markets, facilitating international trade and strategic partnerships.

-

Benefit from Saudi Arabia's Investment Prowess

With $4 trillion worth of projects outlined in Vision 2030, Saudi Arabia showcases a commitment to robust investment.

-

Harness the Potential of a Leading Financial Sector

Saudi Arabia's flourishing financial sector provides a solid foundation for businesses, offering a range of financial services and support.

-

Enjoy the Freedom of 100% Foreign Ownership Opportunities

Businesses can benefit from the freedom of 100% foreign ownership, providing control and flexibility in operations.

-

Benefit from Saudi Arabia's Investment Prowess

With $4 trillion worth of projects outlined in Vision 2030, Saudi Arabia showcases a commitment to robust investment.

-

Leverage its Strategic Global Positioning

Strategically positioned, Saudi Arabia serves as a gateway connecting businesses to key markets, facilitating international trade and strategic partnerships.

-

Harness the Potential of a Leading Financial Sector

Saudi Arabia's flourishing financial sector provides a solid foundation for businesses, offering a range of financial services and support.

Types of Licenses Investors Can Apply For in Saudi Arabia

All licenses are issued based on the principle of fair and equal treatment, allowing international investors to enjoy the same rights and obligations as local investors.

Agricultural license

Agricultural license

This license is issued to companies in the agricultural field.

Audiovisual media license

Audiovisual media license

This license is issued to companies in the audio and visual fields.

Commercial license

Commercial license

This license is issued to companies in the wholesale and retail trading field.

Consulting license for engineering offices

Consulting license for engineering offices

This license is issued to companies providing engineering consultation services within the Kingdom.

Consulting license for technical & economic communication offices

Consulting license for technical & economic communication offices

This license is issued to economic and technical country representation offices.

Entrepreneur license

Entrepreneur license

This license is issued to entrepreneurs who wish to establish technology and innovative companies with expansion and growth potential within the Kingdom.

License for a scientific and technical office

License for a scientific and technical office

This license is issued to companies with offices providing scientific and technical services to agents, distributors and consumers of their products.

License for serving agents and providing workers services

License for serving agents and providing workers services

This license is issued to companies providing domestic labor placement services and temporary employment agencies for households.

Industrial license

Industrial license

This license is issued for all types of industrial activities, such as heavy and light industries and manufacturing.

Mining license

Mining license

This license is issued to companies in the mining field.

Printing & publishing license

Printing & publishing license

This license is issued to companies in the printing and publishing fields.

Professional license with Saudi shareholder

Professional license with Saudi shareholder

This license is issued to companies conducting professional services in the Kingdom with a Saudi partner.

Real estate license

Real estate license

This license is issued to companies in the real estate field.

Services license

Services license

This license is issued for service activities including: advertising and media, logistic services, organizing exhibitions, catering and food services, financial services, aviation, handling services, etc.

Transport license

Transport license

This license is issued for bus public transportation within cities, metro public repetition , and other public transport activities.

Agricultural license

This license is issued to companies in the agricultural field.

Audiovisual media license

This license is issued to companies in the audio and visual fields.

Commercial license

This license is issued to companies in the wholesale and retail trading field.

Consulting license for engineering offices

This license is issued to companies providing engineering consultation services within the Kingdom.

Consulting license for technical & economic communication offices

This license is issued to economic and technical country representation offices.

Entrepreneur license

This license is issued to entrepreneurs who wish to establish technology and innovative companies with expansion and growth potential within the Kingdom.

License for a scientific and technical office

This license is issued to companies with offices providing scientific and technical services to agents, distributors and consumers of their products.

License for serving agents and providing workers services

This license is issued to companies providing domestic labor placement services and temporary employment agencies for households.

Industrial license

This license is issued for all types of industrial activities, such as heavy and light industries and manufacturing.

Mining license

This license is issued to companies in the mining field.

Printing & publishing license

This license is issued to companies in the printing and publishing fields.

Professional license with Saudi shareholder

This license is issued to companies conducting professional services in the Kingdom with a Saudi partner.

Real estate license

This license is issued to companies in the real estate field.

Services license

This license is issued for service activities including: advertising and media, logistic services, organizing exhibitions, catering and food services, financial services, aviation, handling services, etc.

Transport license

This license is issued for bus public transportation within cities, metro public repetition , and other public transport activities.

Documents that are Needed to Receive an INVESTOR LICENSE

Copy of the commercial registration of the entity in its original country, authenticated by a Saudi Embassy

Financial statements for the last year, prepared by an internationally acclaimed legal office and authenticated by a Saudi Embassy

*Additional documents may be required depending on the business activity and the required license type.

6 Simple Steps to Start Business in Saudi Arabia

MISA Investment License

Commercial Registration

Official Authorities Registration

Issuance of the GM Visa

Government Portal Registrations

Bank Account Opening

6 Simple Steps to Start Business in Saudi Arabia

MISA Investment License

Commercial Registration

Official Authorities Registration

Issuance of the GM Visa

Government Portal Registrations

Bank Account Opening

Unlock the Perks of UAE Residency

Obtaining a UAE residence visa through Decisive Zone offers numerous advantages, including the freedom to live and work in the country, access to world-class healthcare and education, and the opportunity to establish a secure future for you and your family

-

Flexibility

Live and work in the UAE without restrictions.

-

Global Reach

Explore international markets and expand your business horizons

-

Financial Growth

Access top-notch banking facilities and fuel your business growth.

-

Visa Services

Hassle-free visa processing and renewal assistance

Navigate the establishment of your business in Saudi Arabia

Not sure where to begin?

Our team of experienced business setup experts is here to guide you through the process. Book a FREE business consultation call today and get answers to your most crucial questions:

- What is the ideal business structure for your goals?

- Which Saudi jurisdiction suits your business type?

- How can you benefit from Saudi's tax advantages?

- What are the key steps for a successful business setup?

Love from our clients

Thousands of people choose Decisive Zone to set up their business in Dubai and across the UAE. We take great pride in our exceptional services and our clients’ testaments keep us going!

Get an estimate

How much does it cost to open a business in the Saudi Arabia?

Get in touch with us to receive your personalized quotation. Provide the necessary details, and our team will promptly assess your requirements to deliver a tailored quote that suits your needs

How Decisive Zone Can Support Your Transition

- Expertise: Benefit from our seasoned professionals who understand the nuances of the Saudi Arabian business landscape.

- Streamlined Process: We simplify the journey, from obtaining licenses to company formation, ensuring a smooth and efficient experience.

- Tailored Solutions: Whether you're starting fresh or expanding, our services are customized to meet your unique business needs

Frequently Asked Questions

- Net Profit Tax: Foreign-owned companies are subject to a 20% tax on their net profit.

- VAT (Value Added Tax): A 15% VAT is applicable to the sale of goods and services.

- Sole Proprietorship: Individual ownership.

- LLC (Limited Liability Company): Shareholder flexibility, limited liability.

- Joint Stock Company: Public or private shares.

- Branch Office: Foreign company branch.

- Representative Office: Non-commercial activities.